1MG FlippingBooks

The clean energy transition won’t happen without copper

By Jessica Martyn

Essential to modern technologies and economic and national security, copper plays a critical role in the Clean Energy Transition – and while the Australian Government has carved out an ambitious implementation plan to shift from fossil fuels to renewable energy sources, the challenges ahead are significant.

Since the oil shocks of the 1970s, there have been strong economic incentives to reduce reliance on fossil fuels, reinforced by considerations of economic and energy security as well as environmental preservation.

Now, if we are to preserve our quality of life as well as our environment in line with ambitious targets for the clean energy transition, we must accelerate the adoption of renewable energy solutions.

To keep global warming to no more than 1.5°C, as called for in the Paris Agreement, emissions need to be reduced by 45% by 2030 and reach Net Zero by 2050. However, to date, government commitments fall far short of what would be required to achieve this goal.

The clean energy transition requires an enormous increase in demand for critical minerals.

In fact, the International Energy Agency (IEA) estimates that the achievement of Net Zero will require a sixfold increase in critical minerals, and the process will be uniquely challenging, according to KGL Resources Executive Chairman Denis Wood.

“What the world is trying to do – to get off oil, the most energy intensive molecule we have, and convert the whole electricity grid and all infrastructure – has never been done before,” Mr Wood said.

As the metal of electrification and the most widely used metal in transmission infrastructure and energy generation and storage, copper is critical to the transition, decarbonisation, and electrification of the global economy, particularly as clean energy technologies are more copper intensive than fossil fuels.

Global supply chain disruptions for copper will directly impact the energy, economic and national security of Australia and our strategic partners – particularly as demand continues to rise across China, India, and much of Southeast Asia.

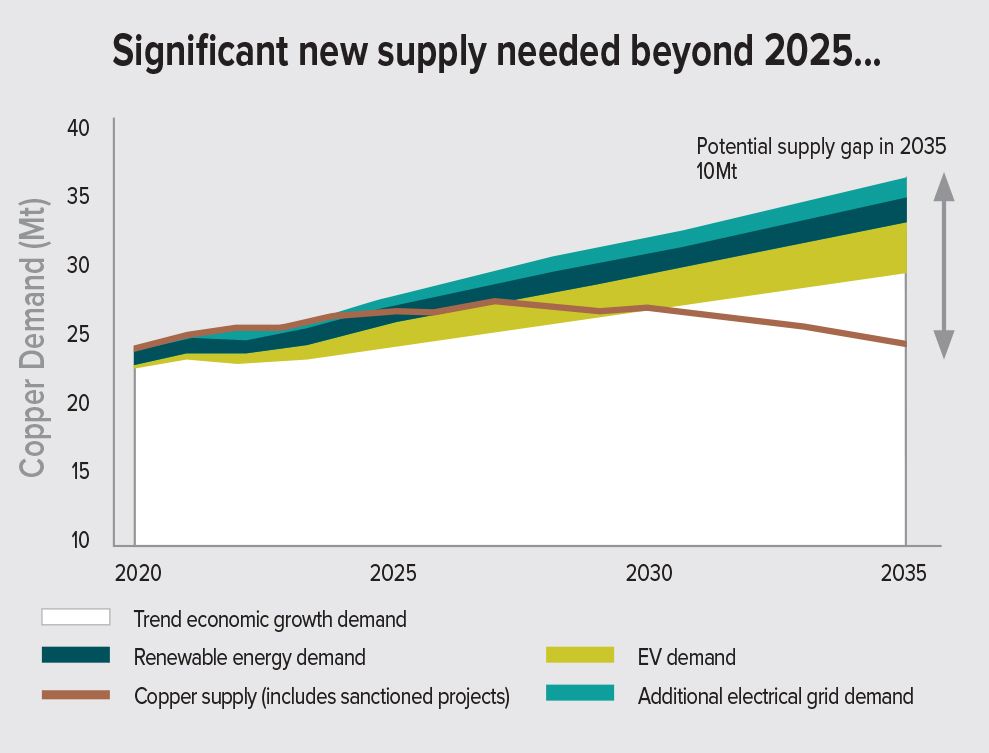

The world is not developing enough copper mines to meet expected demand – and the fact that the construction of each new mine takes seven to ten years only makes the need for investment more urgent. A chronic copper shortfall is forecast to commence in the second half of this decade, threatening the clean energy transition as well as the security of our energy, our economy, and our nation as a whole. In fact, copper scarcity may emerge as a key destabilising threat to international security.

Without adequate investment and support, the supply challenges impacting the clean energy transition are likely to result in energy scarcity and higher prices, a trend which is already occurring in Europe and the UK and fraying consensus on the removal of fossil fuels.

As the home of the world’s second largest copper reserves, our nation is well positioned to play an important role in increasing the supply of copper to support the clean energy transition.

In that regard, KGL’s Jervois project is well positioned as it is one of the few licensed high-grade copper projects that can be in production at a time when the world is expecting to face a long-term structural deficit in the copper market.

However, the mobilisation of our copper resources from deep underground or remote greenfield locations will present challenges, requiring supportive government policies – particularly around the construction of infrastructure, the availability of finance and skilled labour, and the incentivisation of further copper exploration – to be internationally competitive with the large porphyry copper mines in Latin America.

The road ahead may be challenging, but the payoff for investing in Australian mineral projects – a secure, reliable and affordable clean energy supply chain, local job creation, mineral wealth, and security for our nation and our partners – is worth its weight in copper.